The business world keeps changing, and startups need to keep up. For Danish startups trying to get funding, it’s crucial to manage and share sensitive info . That’s where virtual data rooms (VDRs) come in. These digital platforms do more than just share documents – they also make it easier to raise funds, merge companies, and buy businesses. Let’s take a look at how VDRs are shaking up the investment scene for Danish startups. We’ll cover why they’re needed, what good they do, and how to use them best.

Getting to Know Virtual Data Rooms

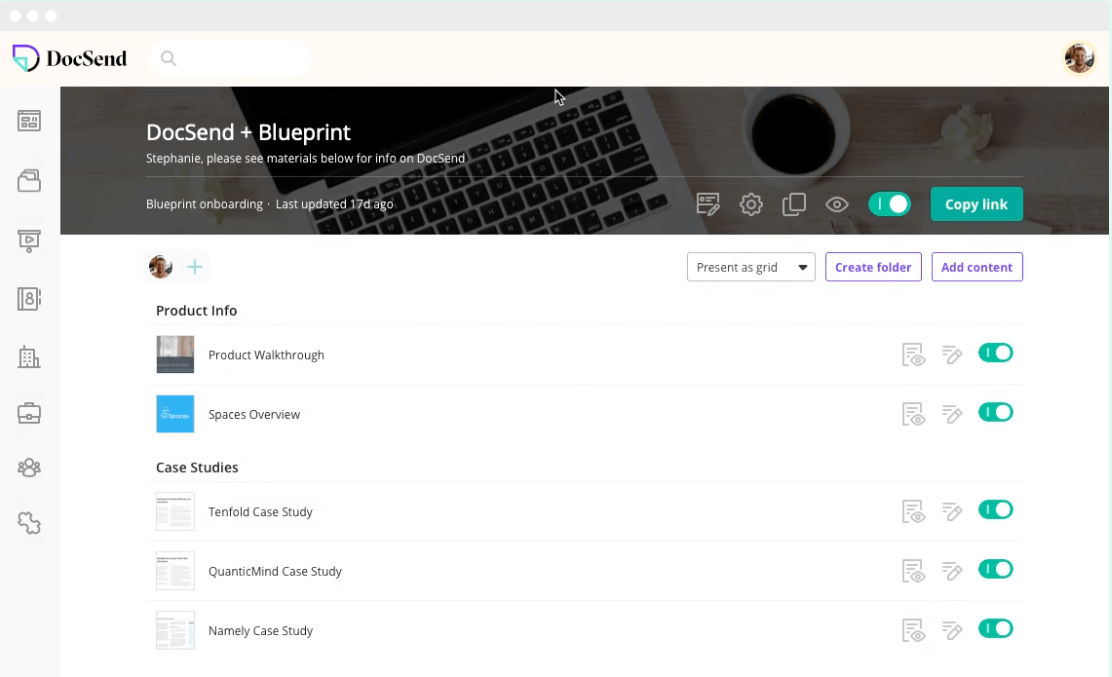

Virtual data rooms are secure online storage spaces for keeping and sharing private documents. Unlike old-school data rooms, which needed real space and paper files, VDRs use cloud tech to offer a central easy-to-access spot for sensitive info. This shift from physical to online spaces has caused a revolution in how companies work during key deals. To learn more about setting up a virtual data room for your startup, check out https://datarums.dk/.

The Evolution of Data Rooms

In the past, data rooms were actual places full of filing cabinets and paper documents. But as tech got better, people realized they needed a smarter way to do things. Virtual Data Rooms (VDRs) came along and helped startups manage their data better cutting down on the time and money spent handling physical documents.

What VDRs Can Do

-

Keep Things Safe: VDRs have strong security features, like encryption and permission settings, which make sure the right people can see sensitive info.

-

Easy to Use: Today’s VDRs have simple designs that make it easy to find your way around and get the documents you need.

-

Real-Time Collaboration: Startups can work together with investors and team members as events unfold, which improves communication and helps them make decisions.

Why Danish Startups Need Virtual Data Rooms

As more Danish startups emerge and grow, they need to manage their data securely and . VDRs play a key role in several important areas:

Fundraising Efficiency

When startups look for investment, VDRs make the fundraising process smoother by giving potential investors quick access to needed documents. These include financial statements, business plans, and market analyses, all kept safe in one place. When startups can show clear brief information, investors often feel more confident and decide to fund more .

Due Diligence Simplification

When investors check out a startup, they need a lot of paperwork to see if it’s worth their money. Virtual data rooms (VDRs) make this easier by putting all the important documents in one spot. This saves time and lowers the chance of losing key info, which could hurt talks.

Better Security

Startups often deal with private information, like their ideas and money details. VDRs have strong safety features that stop people who shouldn’t see this info from getting in. This matters when it comes to following GDPR rules, which is a big deal for companies working in Europe.

The Upsides of Using Virtual Data Rooms

Using VDRs has many perks for Danish startups when they’re trying to get money or make business deals.

Better Organization

VDRs push startups to get their paperwork in order. By sorting files and keeping records up to date, startups can show a polished face to folks who might invest. This tidiness helps with due diligence and makes the startup look more professional.

Investors Feel More Confident

A neat VDR shows that a startup values being open and secure. By giving investors easy ways to see key info, startups can build trust and seem more credible. This matters a lot when trying to get investment, as investors tend to like companies that take charge of managing their data.

Scalability and Flexibility

As startups expand, their data management needs change. VDRs offer scalable answers that can adjust to the shifting demands of a growing company. When a startup broadens its operations or enters new markets, VDRs can handle increased data storage and access requirements.

Best Practices to Use Virtual Data Rooms

To get the most out of VDRs Danish startups should follow several key practices when setting up these platforms.

Organize Documents Effectively

A well-organized VDR is key to enable easy access to crucial documents. Startups should group files using clear naming rules and folder layouts. This organization helps with navigation and improves the overall experience for investors.

Update Content

Keeping the VDR up-to-date with the newest information is crucial. Regular updates make sure investors always have access to the most recent data, which plays a key role in making informed decisions. Also old documents can cause confusion and poor communication.

Control Access Permissions

Startups must handle access permissions within their VDR. By giving access to authorized people, businesses can protect sensitive information from unwanted exposure. This has special importance during the fundraising process where keeping things confidential is key.

Common Use Cases for VDRs in Danish Startups

Danish startups can use VDRs for many purposes beyond fundraising, including:

Mergers and Acquisitions

When it comes to M&A, VDRs make it easier to share information between parties. They boost the productivity of due diligence, which helps potential buyers gauge the value and risks of the target company.

Initial Public Offerings

VDRs can help startups getting ready for an IPO to organize documents needed to comply with regulations. This includes financial reports legal contracts, and info about shareholders, which underwriters and regulatory agencies need to examine .

Legal Transactions

VDRs prove essential in legal deals offering a safe place to share sensitive papers like contracts and agreements. This ensures everyone involved can access the info they need while keeping things confidential.

Overcoming Challenges with Virtual Data Rooms

While VDRs offer clear benefits, startups might face obstacles when putting them into action. Here are some typical roadblocks and ways to get past them:

Cost Considerations

Startups run on small budgets, so the price of VDR services can be a big worry. Companies need to balance the costs with the possible gains. Many VDR companies offer step-by-step pricing plans letting startups pick an option that suits their wallet.

User Adoption

To make a VDR work well, everyone involved must feel at ease using the system. Startups should put money into teaching users and helping them so team members can use the VDR . Giving clear steps and tools can help make the switch easier.

Integration with Existing Systems

Startups might already use different tools to manage data and work together. It’s key to pick a VDR that works well with systems they already have so it doesn’t mess up how they work. Many new VDRs can link up with popular software, which helps get more done.

What’s Next for Virtual Data Rooms

As tech keeps changing, VDRs will get new features and abilities. Here are some trends that could shape how virtual data rooms look in the future:

Better Security

With more online threats showing up companies that make VDRs will put money into better ways to keep things safe. This could mean using things like fingerprints to log in, computer programs that watch for problems, and better ways to scramble data to keep it private.

Adding Smart Computer Programs

The incorporation of AI into VDRs has the potential to cause a revolution in document management. AI can help to automate tasks like document indexing, data extraction, and even predictive analytics making the overall user experience smoother.

More Options to Customize

As new companies try to stand out, they’ll want VDR solutions they can adjust more. Providers might offer more flexible choices letting businesses adapt the VDR interface and features to fit what they need.

To wrap up

In the competitive scene of Danish startups virtual data rooms have an impact on securing investment and making business deals happen. VDRs give startups a safe organized, and productive platform to handle sensitive info allowing them to show themselves in a professional and open way to possible investors. As the startup environment keeps changing, using VDR tech will be crucial for those who want to succeed in an digital world.